Interest Rate Derivatives

Derivatives instruments based on different types of interest rates (SOFR, OIS, LIBOR etc)

Fixed vs Floating interest rates

Interest rates with options

Type of Interest Rate Derivatives

- Mono currency swaps

- Cross currency swaps

- Cap and Floor

- Swaptions

Trade Information

- Trade Date

- Maturity Date

- Notional (can be more than one currency )

- Floating interest rate index

- Fixed interest rate

- Foreign Exchange rate ( in Cross currency swap)

- Strike Rate

Market Data Needed:

- Interest Rate Curve(zero curve , Basis curves)

- FX Spot rates for cross currency swaps

- IR volatility table – Tenors vs Maturity of trade.

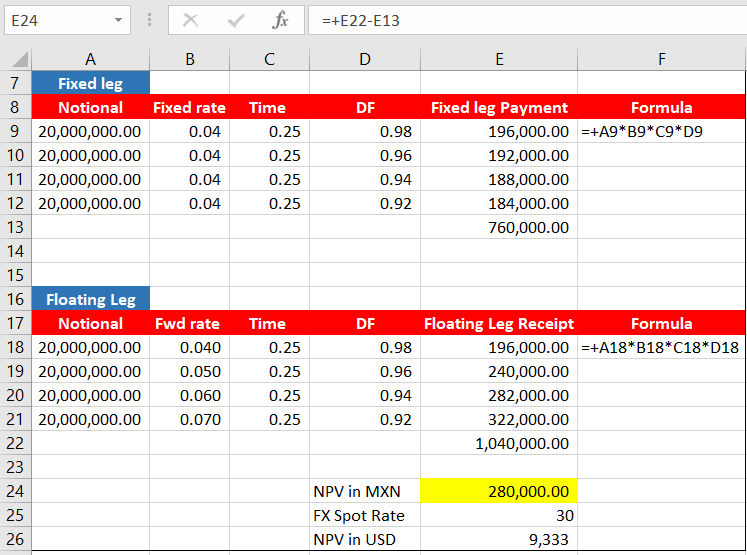

Valuation of Mono Currency Swap.

Mock Trade Information: MXN vanilla Fixed vs Floating swap for 1 Year. The Reset rate and payments are quarterly.

Pay = MXN Fixed Rate 4%

Receive = MXN Floating Rate ( Reset every quarter)

Mock Market Data: Market data needed as below.

MXN zero risk rate curve

MXN Cross Currency Basis curve

MXN Spot rate

Valuation of MXN Swap:

Basis Adjusted MXN curve = MXN zero curve + Basis curve

Basis Adjusted MXN curve is used to forecast forward points and calculate Discount factors for each payment date.

NPV = Floating Leg PV – Fixed Leg NPV

Leg PV = Notional * Fixed/Floating forward point * Time * DF

Quant library:

Basis Adjusted MXN Curve is calibrated using Zero and Basis curves. This is complex process. The final calibrated curve is used to determine forward points and discount factors for each fixed and floating leg.

Time is also determined by the quant library to exact calculation using Daycount basis, Holiday Schedule and Roll forward conventions.

SWAP RISK

MXN Zero(Base) Curve – PV01 is risk for one basis point on each bucket of the Zero interest rate curve.

MXN Cross Currency Basis Adjusted Curve – PV01 is risk for one basis point on each bucket of the Basis adjusted interest rate curve.

MXN Spot FX Rate – FX Delta risk (280,000 MXN pesos)