Credit Derivatives

Derivatives instruments on Credit component on Corporate and Sovereign

Types of Credit Derivatives

- Credit Default Swap

- Credit Default Index

- Total Return Swap

- Credit Linked Note

- Credit Swaption

Trade Information

- Trade Date

- Maturity Date

- Credit Name

- Trade Rate (Fixed or Floating)

Market Data Needed:

- Credit Default Curve

- Credit Index Price

- FX spot if the trade is not in USD

- Credit Volatility

- Bond Price

- Correlation between Credit Name vs FX , Credit vs IR

Valuation of Credit Default Swap

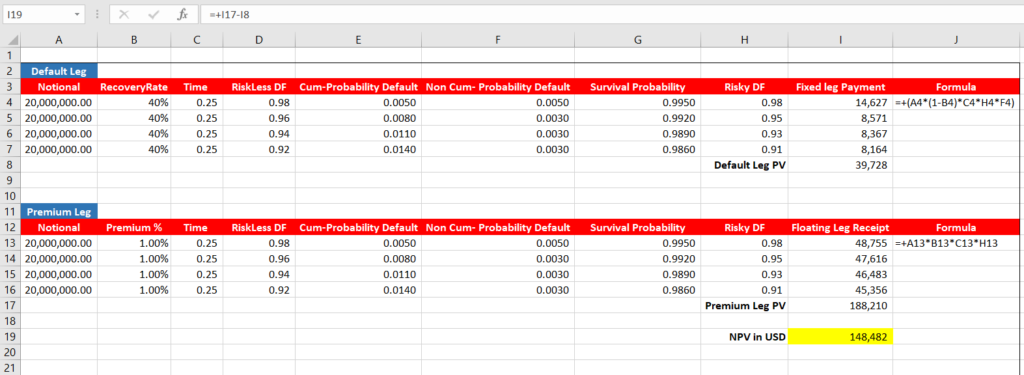

Mock Trade Information: Selling USD Credit Default Swap(CDS) on Mexico for 1 year and resetting quarterly.

Mock Market Data:

USD risk free interest rate curve

Mexico CDS curve

Valuation of Credit Default Swap(CDS):

Cumulative probability default is calculated from CDS curve using Recovery Rate.

Non Cumulative probability = Current cumulative PD – Previous cumulative PD

Survival Probability Default = 1- Cumulative Probability Default.

Riskless DF = Derived from USD risk free interest rate curve

Risky DF = Riskless DF * Survival PD

Riskless DF and Time are calculated same as vanilla interest rate swap.

Sell CDS NPV = Premium Leg PV – Default Leg PV

Premium Leg PV = Notional * Premium Rate * Risky DF * Time

Default Leg PV = Notional * (1 – RR) * Time * Risky DF * Non-Cumulative PD

Credit Default Swap Risks

USD Risk Free Interest Rate curve – PV01 – one basis point change in USD interest curve on each bucket impact on NPV

Credit Default Spread (CDS) Curve – CS01 – One basis point change in CDS curve impact on NPV

Recovery Rate – Change in recovery rate impact on NPV

Even though the CDS is on Mexico name but denominated in USD. There is no foreign exchange risk in this CDS trade