Equity Derivatives

Derivatives instruments on equities traded on exchanges across Globe

Types of Equity Derivatives

- Equity Spot

- Equity Forward

- Equity Index

- Equity Swap

- Equity Options

Trade Information

- Trade Date

- Maturity Date

- Equity Name

- Trade/Strike Price

Market Data Needed:

- Equity Spot Price

- Equity Forward curve

- Equity Volatility

Valuation of Equity Option

Equity option Details:

- OTC vs Exchange Traded: Vanilla American equity options on corporate are exchange traded. Exchange Options prices, delta and other parameters of the valuations are readily available on trading platforms. But Institutions have to trade OTC derivatives due to unavailability of exchange traded options; Clients needs are very specific for example: corporate option not listed, tenors (e.g. longer tenors), specific option or combination of options, option strategy, funding requirement, Note-linked equity options etc.

- Single Name vs Index Options: Option can be on single corporate or Index(S&P Index). Options can be on volatility.

- Vanilla vs Exotic Options: There are simple European and American options as well exotic options – Options on options, chooser options. Lock-in Options, etc.

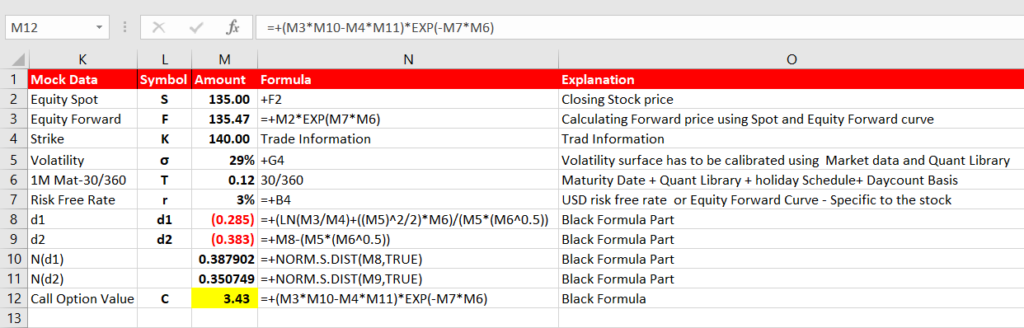

We would be using Black Formula: https://en.wikipedia.org/wiki/Black_model

We need to be thorough:

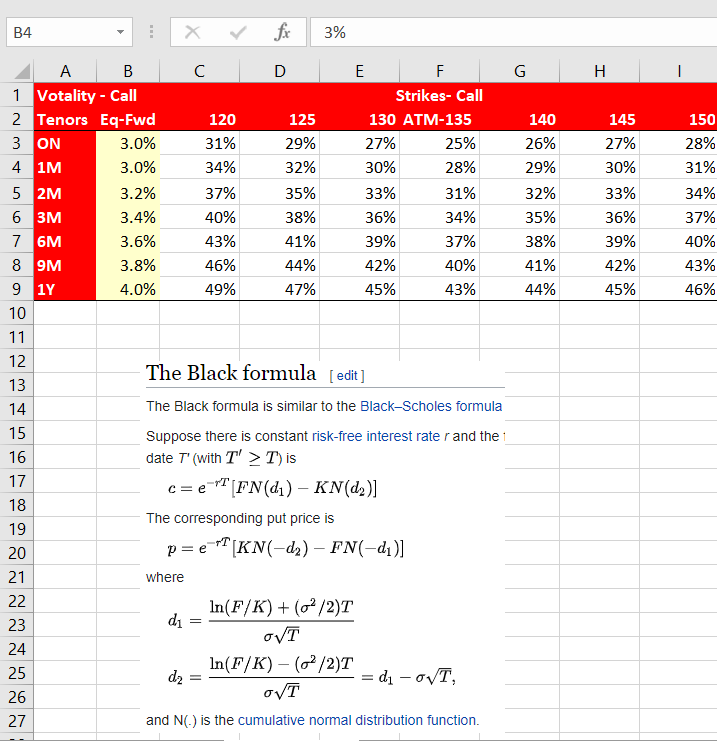

Volatility Surface: The volatility surface is created with the help of Quant Library which uses mainly multiple options volatility observed (sometime unobserved) and Volatility Model. ATM(At-The-Money) volatility is easier but creating volatility surface is mathematical models driven. The market data for volatility surface may not be fully available. Hence, the mathematical model is used to calibrate and interpolate the volatilities. The quant library handle of volatility surface is very flexible. There can be excel based formula using quant library where we can feed the maturity and strike and will get the exact volatility to be used for the valuation. The volatility is accurately determined to value and generate risk for any options, Exotic Options and Options strategy. Hence, the quant library is crucial for volatility surface and eventually valuation and risks of trades. The error or incorrect calculation will bring the loss to the institutions.

Equity Forward Curve: Every asset class symbol(For example, MXN FX Spot, JPM Stock price ) has its own forward curve. The curve is reflection of the forward price of that particular symbol. The interest rate is derived from the forward price which is being used to discount and value the asset.

Risks of European Equity Option

It is important to note that the risks of Equity options varied with different kinds of options and options strategies. European Options are vanilla options and risks profile is simple. Barrier, Digital, options on options, Look-up options etc. do have additional and more complex risks profile , e.g. Pin Risk.

As per above screenshots we have explained the market data usage in valuation of European Equity Option. Hence, market risk is related to each market data component as below:

- Vega Risks: Vega is the measurement of 1% change in volatility. There are mainly two Vega risks ATM and Skew. If the option is not ATM , then the trade Vega changes not just due to ATM volatility but skew (Smile).

- Delta: This is significant risk as the equity price has direct impact on option valuation. This is the measurement of change in option price with the change in equity price (e.g. $1).

- PV01: Interest Rate risk is minimal compare to Delta and Vega. Institutions does keep eye on PV01 risk.

- Theta: Time value of the option. This risk is not specifically calculated but used for P&L attribution to explain the daily P&L(Change NPV day over day).

The daily P&L is mainly attributed to Delta(equity price movement), Vega (ATM and Skew volatility movement), interest rate change and finally remaining maturity which is Theta. In Exotic options, there can be additional attribution or unexplained P&L. There would be additional valuation FVA and IPV adjustments (mostly monthly) .

In addition to Market Risks, the OTC equity options does have counterparty risks. That triggers XVA valuation adjustments.