Foreign Exchange

- Buying and Selling of Foreign Exchange

- Notional in one currency is exchanged with notional in another currency . For example: USD 1MM vs MXN 20MM

- Derivatives on Foreign exchange

Types of Foreign Exchange Derivatives

- FX Spot

- FX Forward

- FX Non Deliverable Forward

- FX Options

Trade Information

- Trade Date

- Maturity Date

- Notional in Base currency (USD)

- Notional in currency (MXN)

- Trade/Strike Price

Market Data Needed:

- FX Spot Rate

- FX Forward Curves

- FX Volatility – Risk Reversal and Strangle

Valuation of FX Forward Trade using mock data

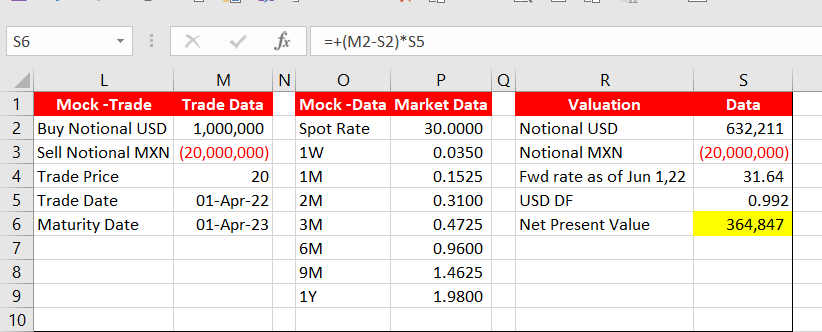

Mock Trade Explain (Column L and M) : This is FX forward trade of buying USD and selling MXN. The trade is entered on April 1, 2022. The notional in USD of $1MM will be exchanged against MXN 20MM exactly after one year. If the USD appreciated , the trade turned out to be in our favor or vice versa.

Mock Market Data Explain (Column O and P) : After 2 months passed, the trade will be matured in 10 months. Hence, the valuation of trade needs spot rate and forward points for 10 months. Spot rate is readily available market data. Usually forward points curve is not exactly available for all our trades maturities. Hence , the forward points is calculated from the forwards points from 9M and 1Y curve points. The quantitative library does this work meticulously. So we have new forward rate using Spot rate and forward point (e.g. 31.64).

Valuation of FX Forward Trade(Column R and S): Now we have new market data (after 2 months passed). We convert MXN leg notional using new forward price. Hence, after evaluating, we conclude that if we enter the trade today with the same maturity, we receive only $632,211 in exchange of MXN 20MM. But our existing trade is providing us $1MM. So we have a gain of $367,789. But this $367,789 will be realized after 10 months(provided there is no change in market data till maturity). Hence, we need to discount $367,789 using USD discount factor(DF). This NPV is good as of June 1st, 2022 using closing market data. We calculate daily NPV using each day closing market data. The daily P&L is the difference between Current Day NPV – Previous Day NPV.

RISKS

- Market Risks:

FX Delta risk on FX spot- MXN 20MM

Interest Rate Risk – PV01 – When we use Forward points then why we have interest rate risks. The explanation below:

Forward Price = Spot + Forward point = FX Spot x (1 + MXN risk-free rate + MXN cross currency Basis) / ( 1 + USD risk-free rate) ( after taken into consideration the tenors.

USD Zero Curve (SOFR Curve)- USD PV01

MXN Zero Curve – MXN PV01

MXN cross currency basis risk– MXN Basis PV01

All above risks are used to calculate IPV and FVA.

Note: G7 currencies are liquid across different asset classes and tenors and hence there are readily available market data from Bloomberg, Reuters, Markit and brokers. But in EM market, interest rate curves (cross currency curves) for short tenors (1D to 2Y) are derived from FX forward points. As well, longer term forward points(> 3Y) are derived from cross currency basis curves.

- Credit Risk(Counterparty Risk): CVA , DVA and Funding Valuation Adjustment on counterparty level.

Valuation of FX Option

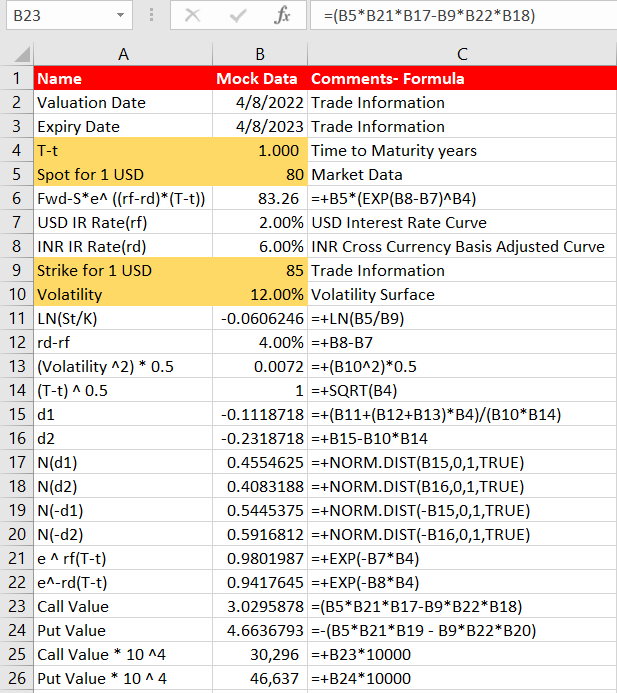

This is European FX option on INR(Indian Rupee) vs USD for 1 Year with strike of 85 rupees.

FX option calculation is very similar to Equity option except we have to use two interest rates (USD and INR). The valuation is in INR in the below screenshot.

The most important is Volatility surface. We observed significant skew (smile) in EM vs USD currency pair. Market is trading FX volatility in Risk Reversal and Smile Strangle strategies. The volatility surface is Delta x Tenors. 25Delta and 10Delta are common market data terms.

25Delta Risk Reversal = RR25D = 25DCall – 25Put (Long underlying)

25Delta Smile Strangle = SS25D = ( 25DCall + 25DPut)/2 – ATM

We can derive 25D Call and 25D Put price or volatility as provided via market data.

RR25D + 2 * SS25D and RR25D – 2 * SS25D equations solved.

The process applies to 10Delta pairs and we get 10D call and 10D put volatility. We would able to create matrix as below. Once we have the volatility and price then we can derive the strike price using the valuation model. Every point in the Volatility Matrix has 3 information Strike, Price and Volatility. There are many volatility models like Dupire Local Model, Black Scholes , SABR etc. are implemented to calibrate, interpolate and extrapolate further the volatility surface. That means we can get volatility, strike and price for 5Delta and/ or 35 Delta.

Risks of FX Option

The above INR FX Option valuation screenshot shows the data usage in valuation. Here are the markets risks:

- Delta: Change in INR vs USD spot rate impact significantly option value.

- Vega: Change in Volatility trigger Vega risk. In FX options, in addition to ATM Vega , RR and SS Vega risks to capture smile risks.

- PV01: USD and INR interest rate curves do have impact on option valuation but still minimal.

- Theta: Change in remaining maturity is also driving part of the valuation.

The FX Option P&L is explained by Delta, Vega, PV01 and Theta. There can be Gamma risks and explanation when the market moved significantly from one day to another.